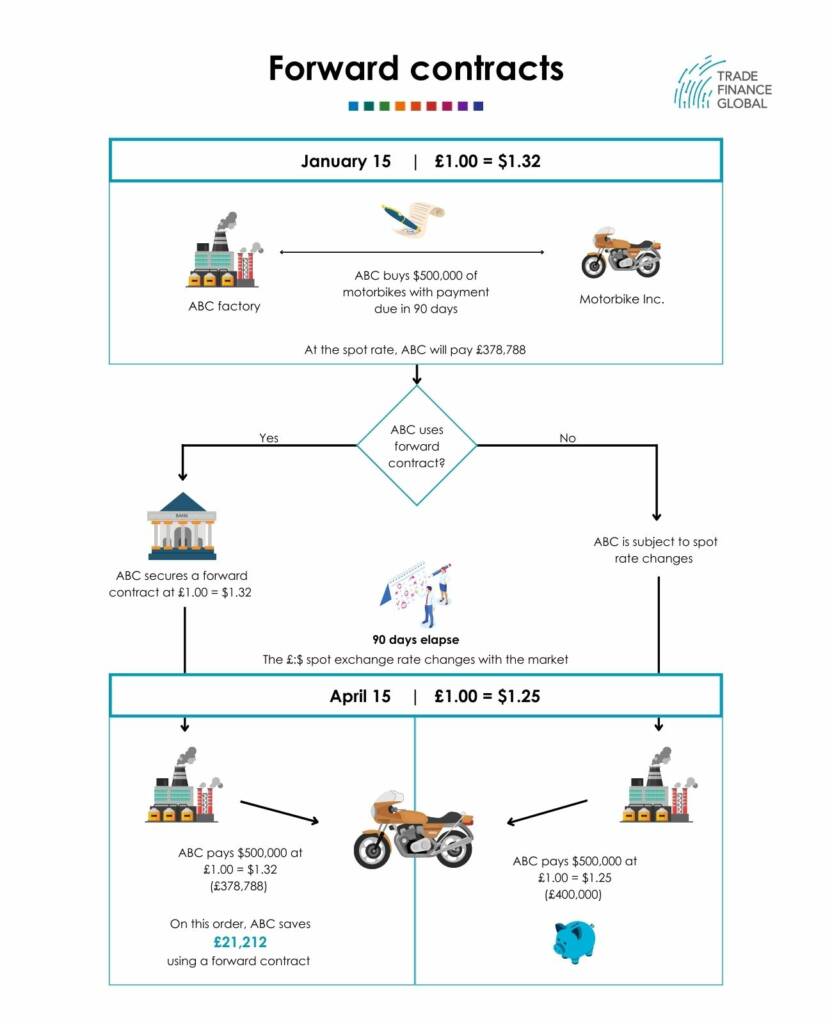

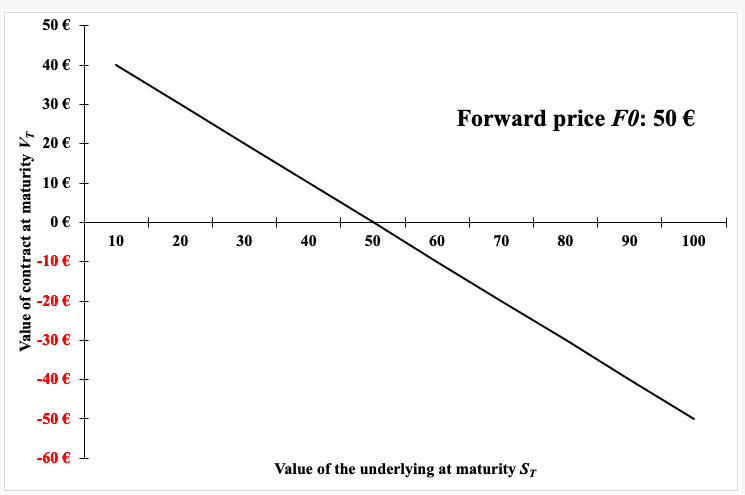

An off-market forward contract is a forward where either you have to pay a premium or you receive a premium for entering into the contract. (With a standard forward contract, the premium

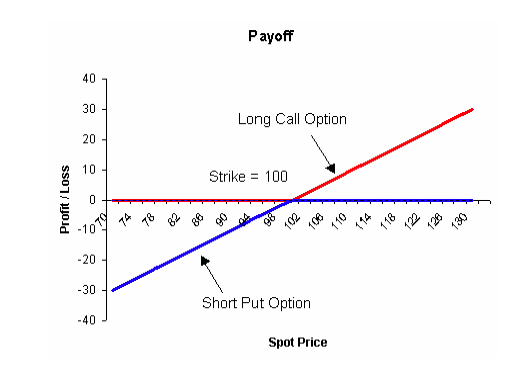

Derivatives Crash Course for Dummies: What is wrong with the payoff profile of the synthetic forward? - FinanceTrainingCourse.com

:max_bytes(150000):strip_icc()/ForwardContract_Final_4196098-a745f40c47f04d2fb8634295b4b8241b.jpg)

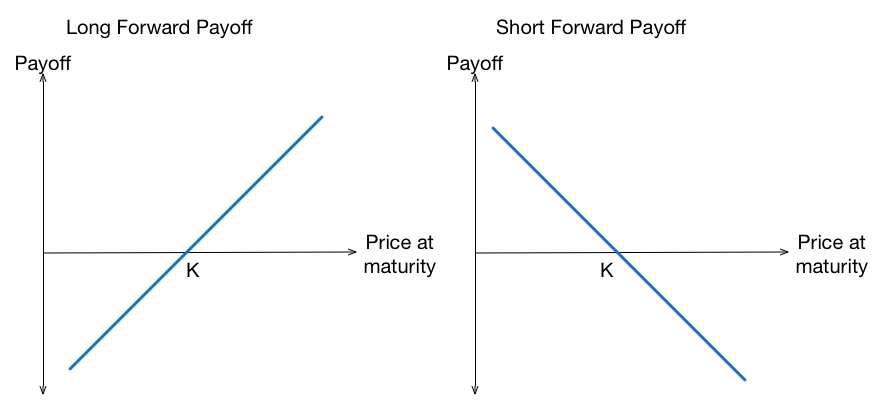

![FM] Options – II: Payoff diagrams | A Matter of Course FM] Options – II: Payoff diagrams | A Matter of Course](http://vineetv.files.wordpress.com/2013/10/payoff-diagram-forwards.png?w=700)